BRUSSELS, July 25, 2022 /PRNewswire/ -- Euroclear today provides an update on its performance in the first half of 2022.

Financial summary

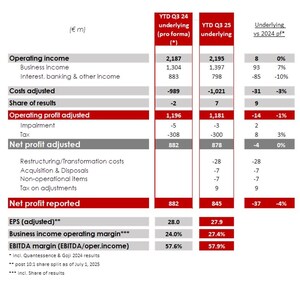

Euroclear delivered a strong financial performance in H1 2022, with the underlying business continuing to perform well. Euroclear also reported higher interest earnings due to rising interest rates on cash balances as well as increased cash balances from frozen assets due to Russian sanctions.

Net profit increased 42% to EUR 351 million, of which EUR 277 million resulted from the strong underlying business performance.

Euroclear Holding |

|||||||||||

H1 2021 |

H1 2022 |

H1 2022 |

Underlying vs |

||||||||

(€ m) |

2021 |

||||||||||

Operating Income |

806 |

998 |

892 |

86 |

11 % |

||||||

Business income |

753 |

807 |

811 |

58 |

8 % |

||||||

Interest, banking & other income |

53 |

191 |

81 |

28 |

53 % |

||||||

Operating Expenses |

-476 |

-534 |

-529 |

-53 |

-11 % |

||||||

Operating Profit before impairment |

330 |

464 |

363 |

33 |

10 % |

||||||

Impairment |

-2 |

-1 |

0 |

2 |

|||||||

Pre tax profit |

328 |

463 |

363 |

35 |

11 % |

||||||

Tax |

-81 |

-112 |

-87 |

-6 |

-8 % |

||||||

Net profit |

247 |

351 |

277 |

29 |

12 % |

||||||

Reported EPS |

79.8 |

111.7 |

87.9 |

8 |

10 % |

||||||

Business income operating margin |

36.8 % |

33.8 % |

34.8 % |

||||||||

EBITDA margin (EBITDA/oper.inc) |

47.3 % |

52.0 % |

46.8 % |

||||||||

Note: H1 2021 figures (except for EPS) have been restated to include MFEX pro forma, in order to allow for like-for-like comparison.

Operating income was up 24% year-on-year to EUR 998 million. Business income was up 7% to EUR 807 million, reflecting the continued strong growth of Euroclear's core business lines as it implements its strategy.

Interest, banking and other income increased by 262% to EUR 191 million as a consequence of rising interest rates and higher cash balances from frozen assets due to the Russian sanctions.

Operating Expenses increased to EUR 534 million, up 12% compared to H1 2021, as Euroclear continued to invest in its technology and service offering, as well as being impacted by inflation and costs related to managing the Russian sanctions.

An increase of 40% in earnings per share to EUR 111.7 per share, reflected the increase in net profit.

Implications of frozen assets due to Russian sanctions

As a result of sanctions imposed by the US, the EU and other jurisdictions, as well as Russian countermeasures, the cash on the balance sheet has increased as blocked coupon payments and redemptions accumulate. During the first half of 2022, Euroclear Bank's balance sheet increased by €72 billion year-on-year.

At the end of June 2022, Euroclear Bank's cash balances had increased by €72 billion year-on-year. As per Euroclear's standard process, the cash is invested which results in interest income. During the first half, the interest income earned from frozen assets held as a result of Russian sanctions was EUR 110 million.

The Board expects these interest earnings to grow materially as blocked payments and redemptions continue to accumulate in a rising interest rate environment.

While this is expected to have an impact on the balance sheet, it should not result in material change in credit risk profile and therefore will not have a meaningful impact on the group's capital ratios.

Business Performance & H1 Highlights

Euroclear's underlying business continues to perform strongly. Excluding the impact of frozen assets due to the Russian sanctions, adjusted net profit rose by 12% to EUR 277 million.

Adjusted operating income was up 11% to EUR 892 million. This was driven by adjusted business income growth, up 8%. Adjusted Interest, Banking and Other income was up 53% to EUR 81 million.

The key operating metrics, shown below, underpinned the strong business performance during the period. Market volatility remains high, driving transaction volumes to record levels. Equity market valuations have fallen significantly during the period which has restricted growth in assets under custody and fund asset under custody during the period.

H1 total |

% change vs H1 2021 |

|

Assets under Custody |

EUR 35.5 trillion |

+1 % |

Number of Transactions |

155.5 million |

+4 % |

Turnover |

EUR 523 trillion |

+9 % |

Fund assets under custody |

EUR 2.8 trillion |

+1 % |

Collateral Highway |

EUR 1.9 trillion |

+13 % |

Euroclear continues to see very strong demand for collateral management and lending services from a broad range of market participants. Since 2016, structural demand has been driven by the introduction of the Uncleared Margin Rules (UMR) under Basel III as more participants were require to adopt collateral management services to reduce the risk of derivatives exposures. The fifth wave of the UMR came into force last year.

In the second quarter, Euroclear launched a new ESG reporting solution for asset managers, through the combination of MFEX by Euroclear and Greenomy, two recent investments. In addition to illustrating the benefits of the expanded product offering, the new service demonstrates Euroclear's increased strategic focus on Sustainable Finance.

The integration of MFEX is progressing to plan as MFEX's established fund distribution platforms are combined with Euroclear's post-trade expertise to create a new end-to-end funds offering.

The group also continues to modernise its legacy technology infrastructure, including the domestic CSDs. These investments will further strengthen the resilience and efficiency of the group's platforms, allowing for further digitalisation and service enhancements.

Dividend on 2021 results

The Board confirms its intention to pay its previously announced dividend of EUR 88.5 per share (equating to a total of EUR 279 million) in the fourth quarter of 2022. The dividend, which was delayed while the potential implications of the sanctions on capital were evaluated and mitigated, relates to the performance in the 2021 financial year.

Commenting on the results

Lieve Mostrey, Chief Executive Officer

"We delivered a strong performance across the business and saw an increase in interest earnings due to higher interest rates and accumulated cash balances as a consequence of frozen assets due to the Russian sanctions.

In a context where financial market conditions have been dynamic, we have continued to operate safe and efficient infrastructure to support our clients.

As we look forward, we see opportunities to further enhance our client offerings, such as through innovative data-enabled services and connecting to global markets, while meeting our responsibilities as a financial market infrastructure to support sustainable economic growth."

Note to editors

Euroclear group is the financial industry's trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency and connections to financial markets for sustainable economic growth.

Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation and efficiency at scale for its global client franchise.

The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden, Euroclear UK & International and MFEX by Euroclear.

Annex

H1 2022 |

H1 2021 |

Variance |

||||||

Euroclear Bank Income Statement |

||||||||

Net interest income |

203.8 |

48.6 |

155.2 |

|||||

Net fee and commission income |

511.1 |

455.4 |

55.7 |

|||||

Other income |

-4.8 |

6.6 |

-11.4 |

|||||

Total operating income |

710.1 |

510.6 |

199.5 |

|||||

Administrative expenses |

-314.3 |

-287.1 |

-27.1 |

|||||

Operating profit before impairment and taxation |

395.8 |

223.5 |

172.4 |

|||||

Result for the period |

301.8 |

171.0 |

130.7 |

|||||

Euroclear Bank Statement of Financial Position |

||||||||

Shareholders' equity |

2,306.6 |

1,976.6 |

330.0 |

|||||

Debt securities issued and funds borrowed (incl.subordinated debt) |

5,029.8 |

6,004.5 |

-974.8 |

|||||

Total assets |

103,634.3 |

31,160.3 |

72,473.9 |

|||||

Euroclear Investments Income Statement |

||||||||

Dividend |

0.0 |

270.0 |

-270.0 |

|||||

Net gains/(losses) on non trading financial assets at FVPL |

-418.3 |

-26.4 |

-391.9 |

|||||

Other income |

1.9 |

1.5 |

0.3 |

|||||

Total operating income |

-416.4 |

245.1 |

-661.6 |

|||||

Administrative expenses |

-2.6 |

-0.5 |

-2.1 |

|||||

Operating profit before impairment and taxation |

-419.1 |

244.6 |

-663.7 |

|||||

Result for the period |

-314.5 |

250.7 |

-565.1 |

|||||

Euroclear Investments Statement of Financial Position |

||||||||

Shareholders' equity |

474.2 |

770.3 |

-296.1 |

|||||

Debt securities issued and funds borrowed |

1,647.7 |

1,646.2 |

1.5 |

|||||

Total assets of which |

2,122.4 |

2,460.7 |

-338.4 |

|||||

Loans and advances (excluding intercompany) |

54.1 |

416.5 |

-362.4 |

|||||

Fair Value through Other Comprehensive Income |

301.2 |

311.2 |

-10.0 |

|||||

Intercompany loans |

902.8 |

1,151.6 |

-248.7 |

|||||

Note: The volatility in financial results for Euroclear Investments in H1 2022, compared to H1 2021, resulted mainly from the impact of higher interest rates on fair valuation of assets under IFRS 9 and the proceeds coming from the bond issued by Euroclear Investments in June 2021. |

||||||||

Contact:

Martin Gregson

martin.gregson@euroclear.com

+32 486 084 085

Thomas Churchill

thomas.churchill@euroclear.com

+32 471 636 535

Logo - https://mma.prnewswire.com/media/832898/Euroclear_Logo.jpg

Share this article